If you are having a hard time accessing the Self Assessment Tax Return Login page, Our website will help you. Find the right page for you to go to Self Assessment Tax Return Login down below. Our website provides the right place for Self Assessment Tax Return Login.

https://community.hmrc.gov.uk › customerforums › sa

I have submitted the self assessment tax return on 22 Jan for tax year 2022 2023 the last part of tax return showed that there is an amount of tax to be paid by 31 Jan I login the personal tax account but it shows there is nothing to pay NB this is the first time I submit tax return so my payment on account balance is zero Please

https://community.hmrc.gov.uk › customerforums › sa

How to have a self assessment account on line for a very elderly person so a person appointed as an attorney LPA registered by the OPG and submitted to HMRC if the elderly person the donor understandably does not have photo ID etc as required by HMRC Please facilitate the process for an attorney to prepare a self assessment return and

https://community.hmrc.gov.uk › customerforums › sa

I created both in June 2023 Now when I login to HMRC I do not see Self Assessment tile on my personal tax account I ve tried many times to fill in an online form by following a link which was meant to register for self assessment if you are NOT self employed as I work full time for my employer and my tax is deducted through PAYE

https://community.hmrc.gov.uk › customerforums › sa

I m registed for Self Assessment employed pay tax via PAYE have submitted my return for YE 22 but also want submit returns for prior years YE 21 YE22 in order claim tax relief on pension contributions paid after tax These years have not been requested by HMRC and thus don t appear in Tax Return Options or More Self Assessment Options

https://community.hmrc.gov.uk › customerforums › sa

If you are unable to access the Self Assessment online then you will need to contact my colleagues on the Online Helpdesk Technical support with HMRC online services If you had submitted a paper tax return then once you are online if received this will be shown on your account and you would not be able to then file online

https://community.hmrc.gov.uk › customerforums › sa

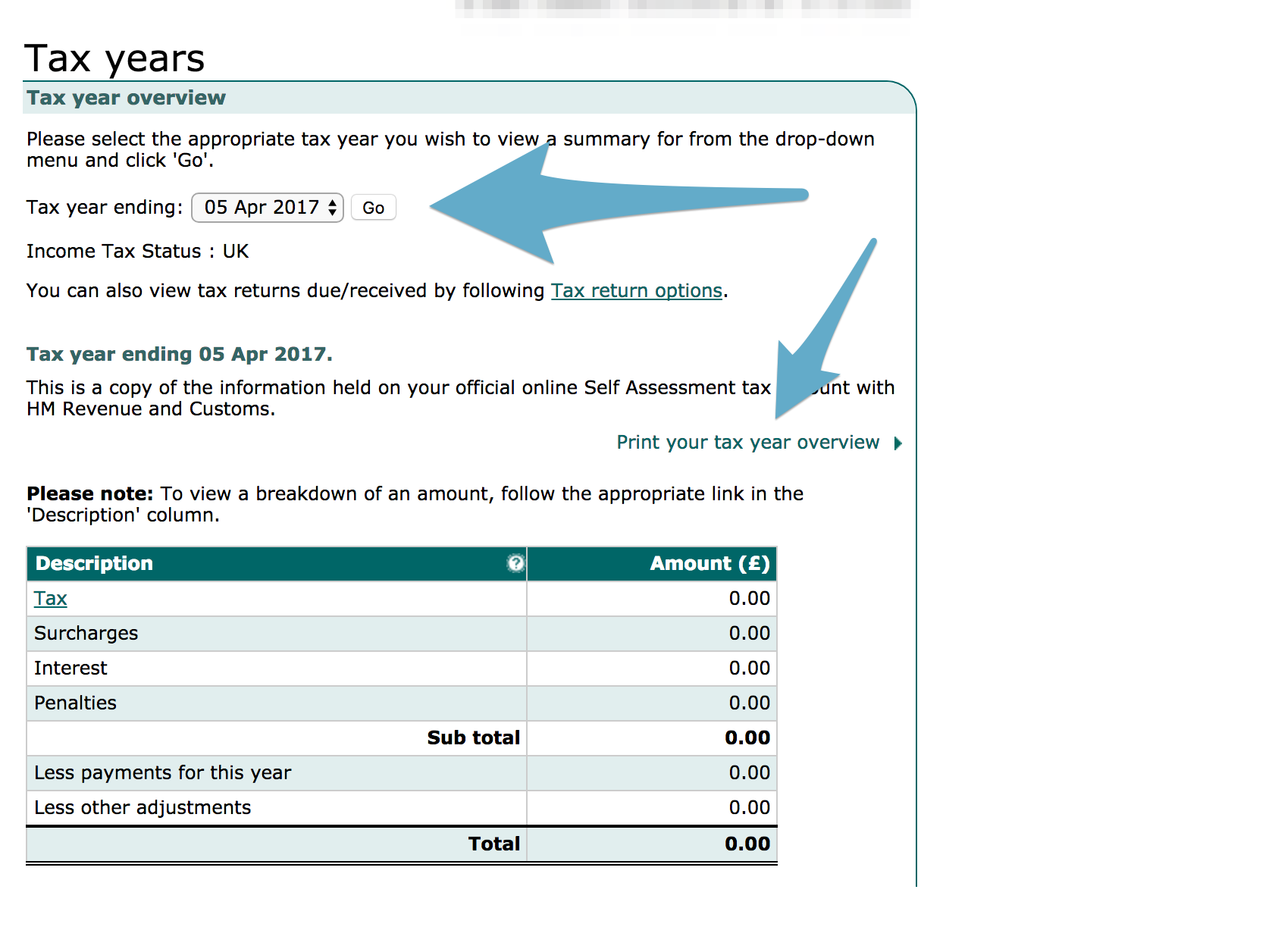

From Your tax account choose Self Assessment account Choose More Self Assessment details Choose At a glance from the left hand menu Choose Tax return options Choose the tax year for the return you want to amend Go into the tax return make the corrections and file it again Thank you

https://community.hmrc.gov.uk › customerforums › sa

If you cannot see the Self Assessment option on your personal tax account and you did not send a return online last year you may need to register for Self Assessment again you will still ultimately use your current UTR to file your next return though You can find more information here File your Self Assessment tax return online

https://community.hmrc.gov.uk › customerforums › sa

So my issue basically the HMRC system is not sending an access code to my mobile when I login and try and submit my self employment self assessment tax return I ve never had this issue before and have been using the same mobile and its phone number for more than six years for my HMRC login

https://community.hmrc.gov.uk › customerforums › sa

I ask because the amount pre populated by HMRC on a friend s return is exactly 1 7 x weekly amount less than their actual new state pension entitlement for the last tax year and their pension started on day 7 of a pension week during the tax year meaning they were entitled to and received 1 day plus 3 weeks in the first 4 week payment schedule

Thank you for visiting this page to find the login page of Self Assessment Tax Return Login here. Hope you find what you are looking for!