If you are having a hard time accessing the Tennessee Sales Tax Exemption Application page, Our website will help you. Find the right page for you to go to Tennessee Sales Tax Exemption Application down below. Our website provides the right place for Tennessee Sales Tax Exemption Application.

https://www.tn.gov/revenue/taxes/sales-and-use-tax...

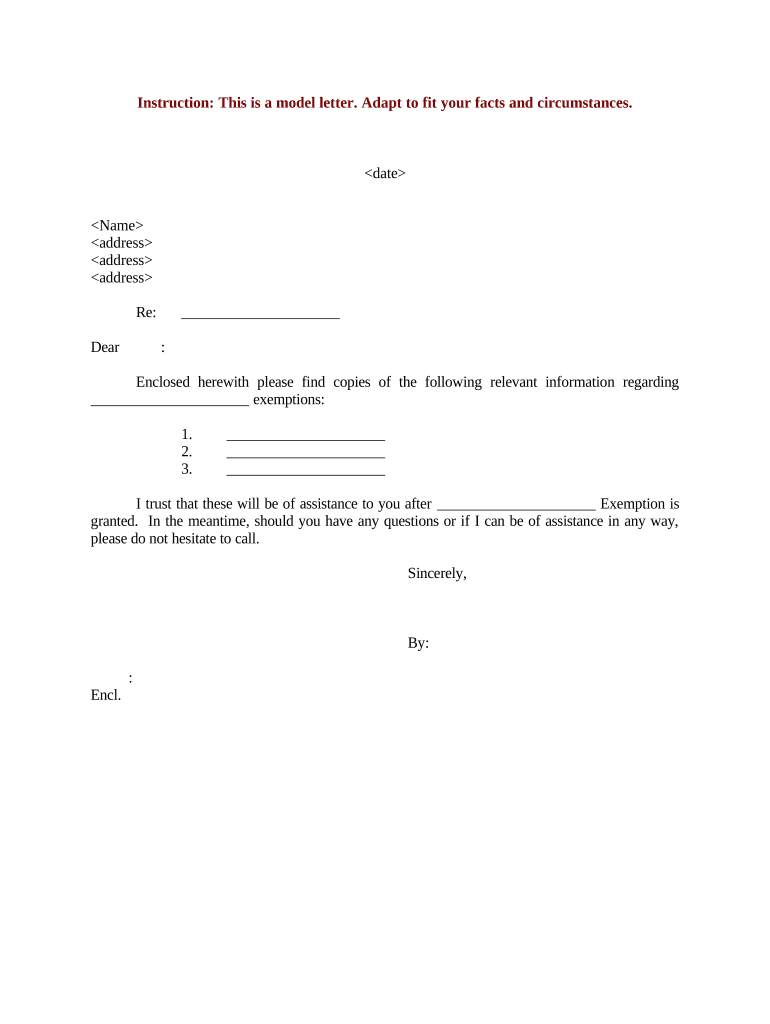

Sales and Use Tax Exemption Verification Application Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because they are making a purchase for a non profit organization an individual or a business possessing a valid Tennessee certificate of exemption Information

https://www.tn.gov/revenue/taxes/sales-and-use-tax/forms

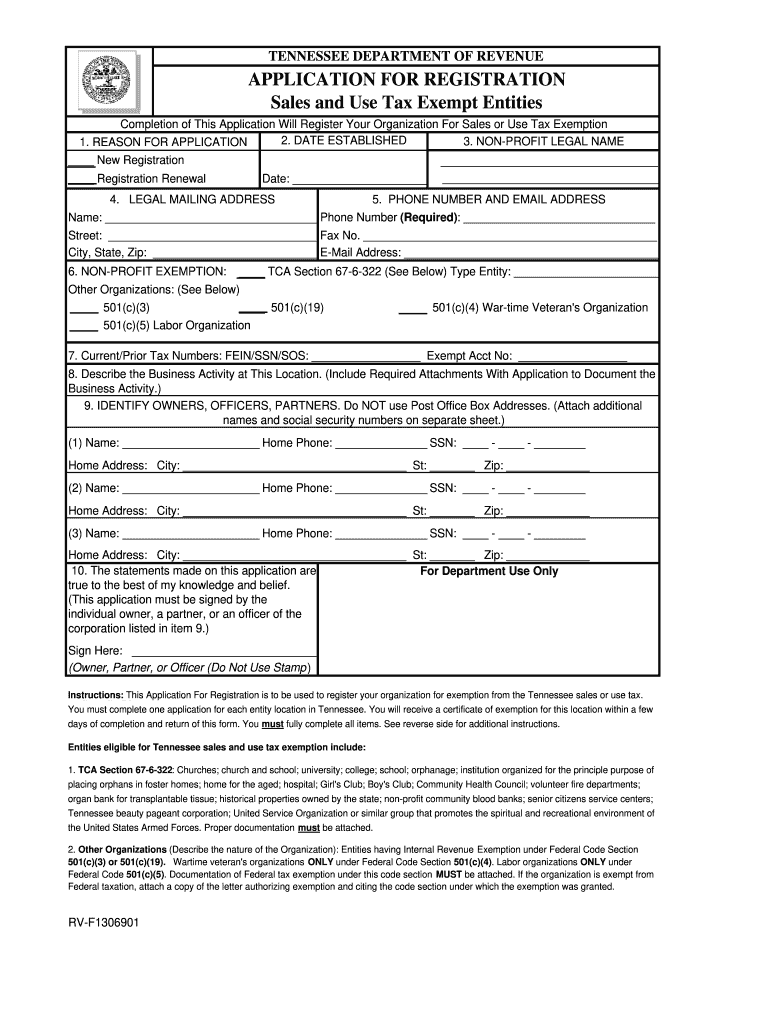

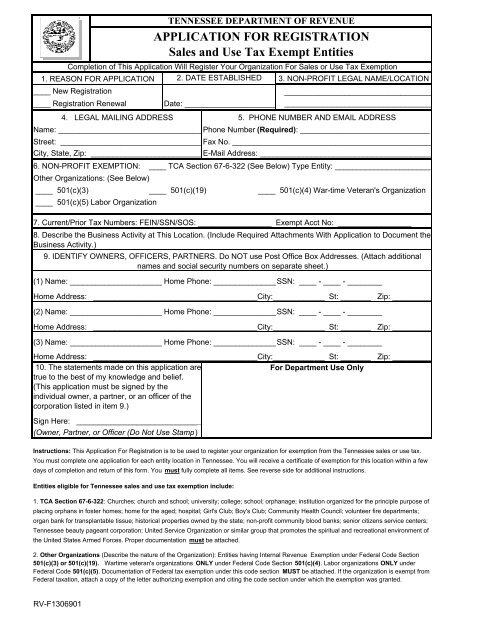

Application for Broadband Infrastructure Sales and Use Tax Exemption Application for Research and Development Machinery Sales and Use Tax Exemption Application for Registration Sales and Use Tax Exempt Entities or

https://revenue.support.tn.gov/hc/en-us/articles/...

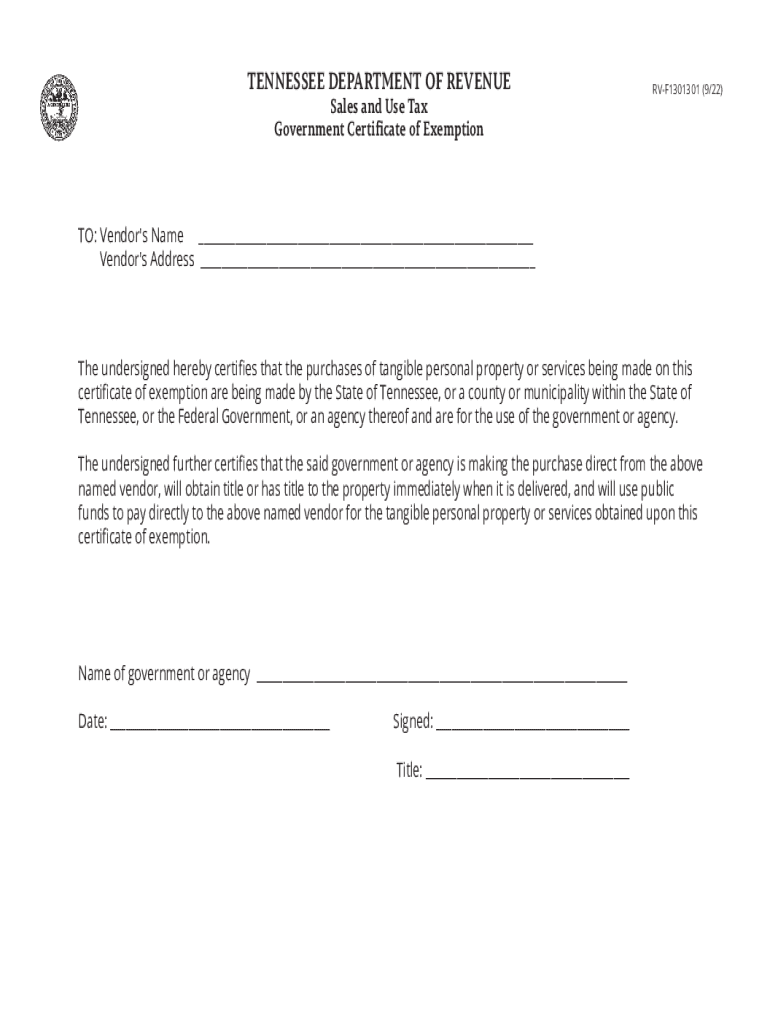

The Tennessee Government Exemption Certificate paper form that is fully completed and signed may be used by the Federal Government and its agencies the State of Tennessee and its agencies or a county or municipality of the State of Tennessee and their agencies to claim the government sales and use tax exemption for sales made directly to the

https://revenue.support.tn.gov/hc/en-us/articles/...

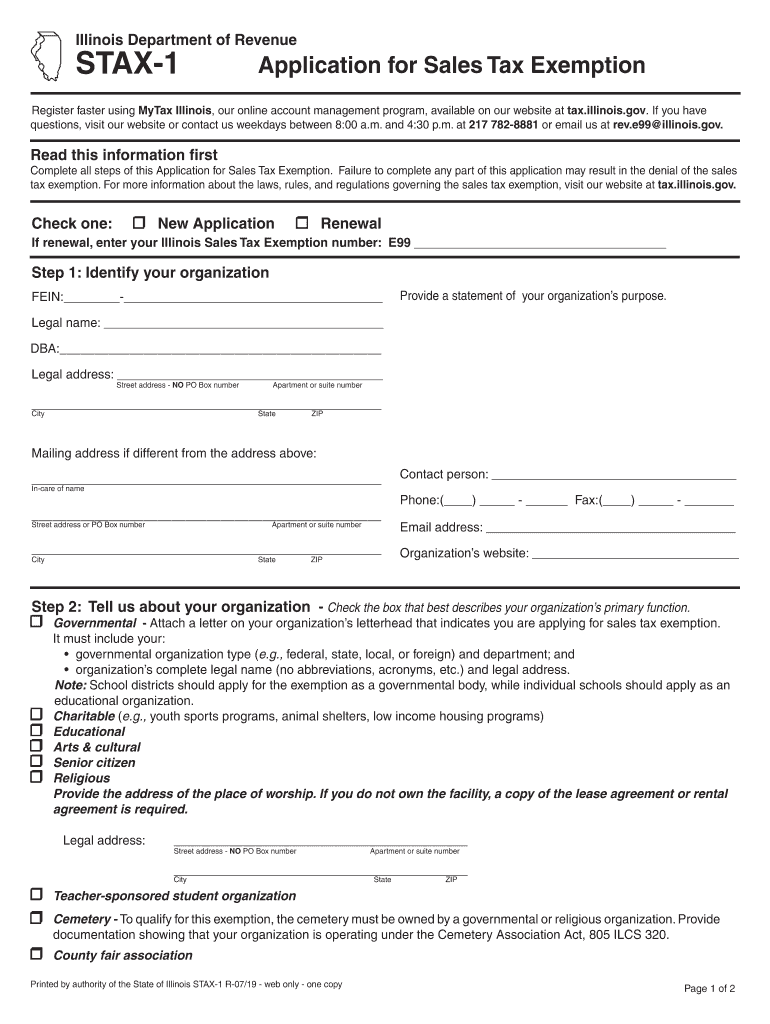

Generally nonprofit entities are exempt from paying sales or use tax on their purchases of property and services A nonprofit entity must apply for and receive the Sales and Use Tax Certificate of Exemption from the Department of

https://www.createtn.com/lib/file/manager/FE...

Tenn Code Ann 67 6 323 provide sales and use tax exemptions for the sale use storage or consumption of tangible personal property computer software or services that are necessary to and primarily used for a qualified production

https://pnts.org/new/wp-content/uploads/2014/12/TN...

Instructions This Application For Registration is to be used to register your organization for exemption from the Tennessee sales or use tax You must complete one application for each entity location in Tennessee

https://revenue.support.tn.gov/hc/en-us/articles/...

If an organization qualifies as exempt from sales and use tax under Tenn Code Ann 67 6 322 it must complete and submit an Application for Exempt Organizations or Institutions Sales and Use Tax Exemption for each location in Tennessee

https://www.tn.gov/.../forms/sales/f1308401.pdf

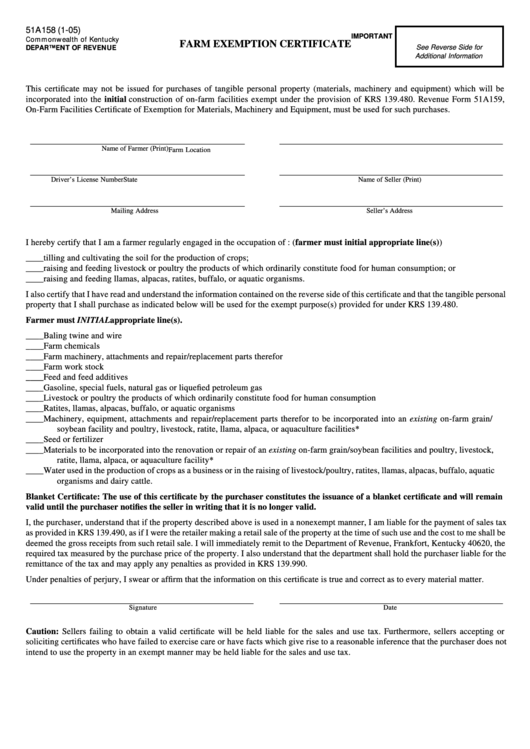

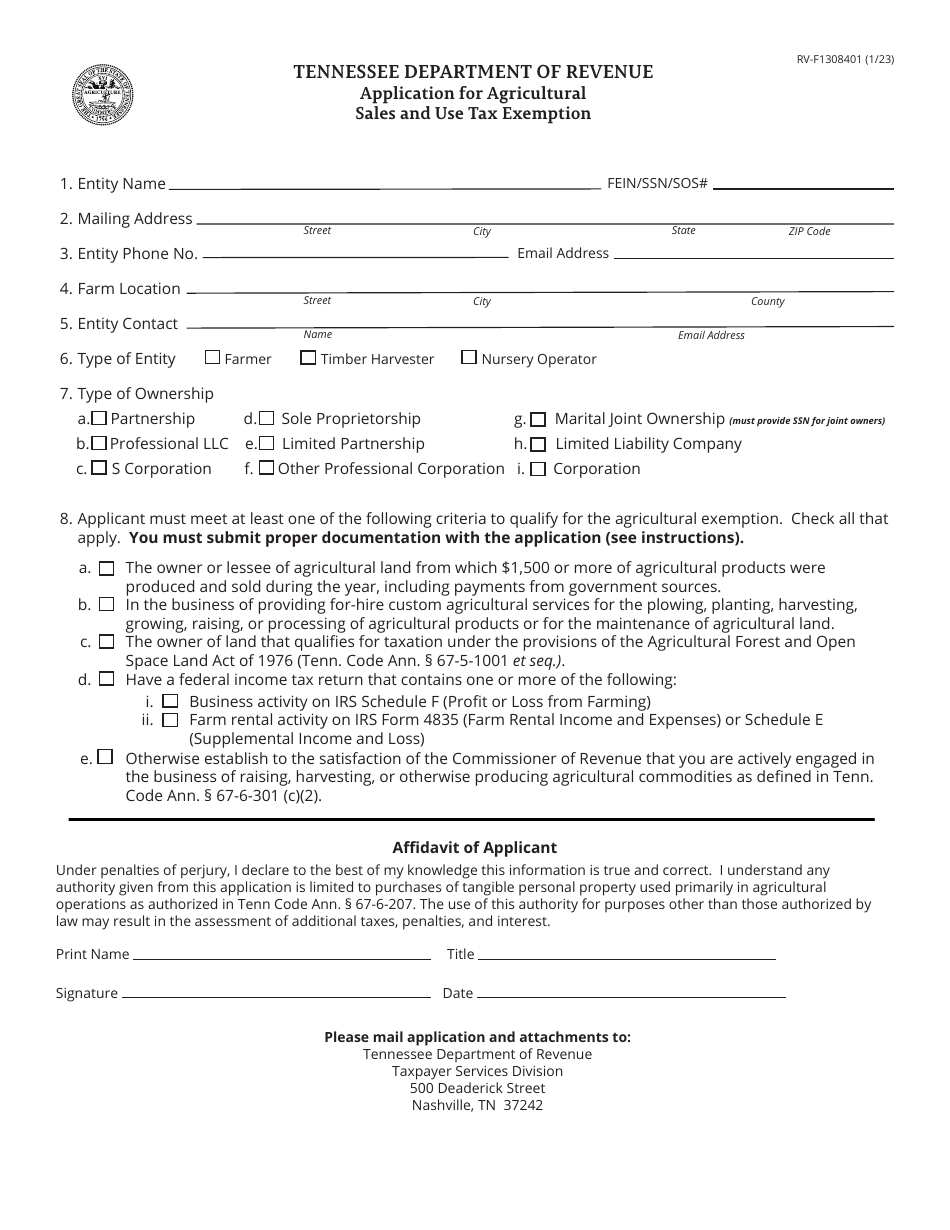

A qualified farmer timber harvester or nursery operator must apply for and receive an Agricultural Sales and Use Tax Certificate of Exemption before making tax exempt purchases Applicants must complete this form in its entirety and mail it and all requested information to the Department of Revenue at the address on the front page

https://www.salestaxhandbook.com/tennessee/sales...

This page explains how to make tax free purchases in Tennessee and lists four Tennessee sales tax exemption forms available for download

Thank you for visiting this page to find the login page of Tennessee Sales Tax Exemption Application here. Hope you find what you are looking for!