If you are having a hard time accessing the Registering For Vat page, Our website will help you. Find the right page for you to go to Registering For Vat down below. Our website provides the right place for Registering For Vat.

https://www.accountingweb.co.uk/tax/business-tax/late-vat-registrati…

Likewise if a business could just avoid registering for VAT when they are required to do so but take the risk HMRC will never find out then that risk would with a four year time

https://www.accountingweb.co.uk/any-answers/registering-vat-in-mid…

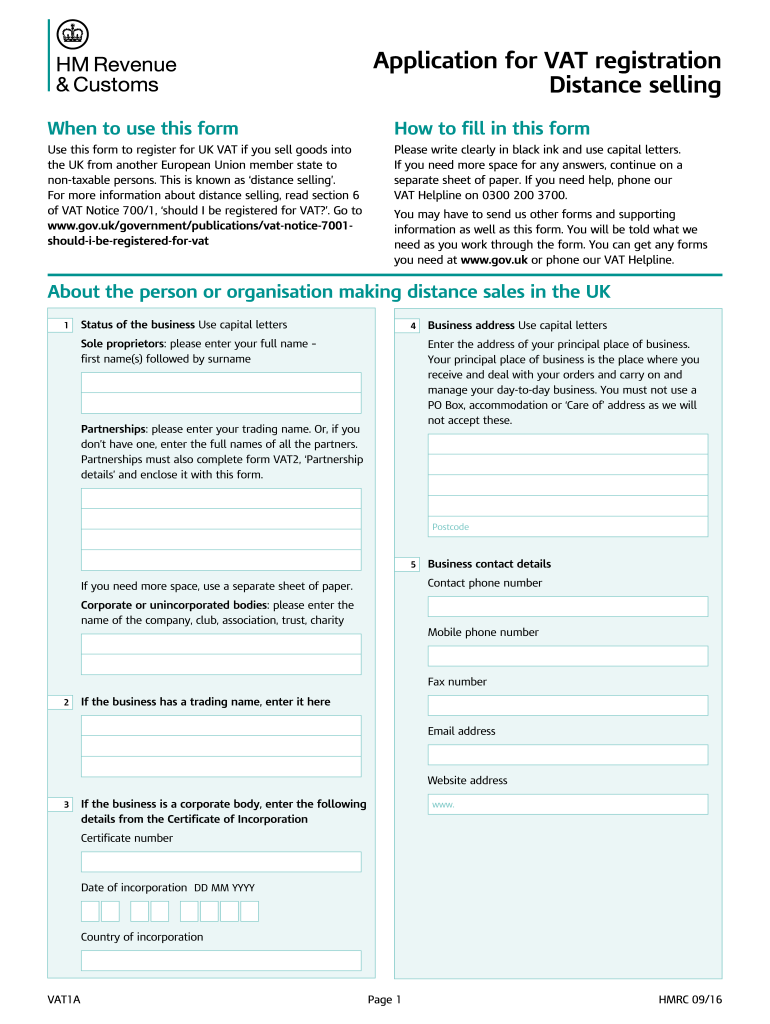

Until you receive your VAT registration number you must not charge VAT or show VAT on your invoices To make sure that you do not lose income in the period after you

https://www.accountingweb.co.uk/any-answers/vat-on-sales-invoice…

Secondly the business was registered for VAT with effect from 1 October meaning VAT invoices must not be issued before this date The work was carried out in

https://www.accountingweb.co.uk/any-answers/registering-for-vat-as …

If you are using your agent gateway when registering for VAT one of the questions asked is if you are registering for VAT for yourself or someone else select someone else

https://www.accountingweb.co.uk/community/industry-insights/buyin…

The first and most common reason to register is when a scheme purchases a property where the vendor has opted to tax In these circumstances VAT would normally be

https://www.accountingweb.co.uk/tax/business-tax/vat-deregistratio…

VAT expert Les Howard outlines a number of basics and pitfalls around deregistering for VAT There are two basic circumstances in which you can deregister for VAT

https://www.accountingweb.co.uk/any-answers/vat-registration-for-so…

To access the new VRS service correctly agents should use the link available at VAT registration applications exceptions and changes or Register for VAT How to register

https://www.accountingweb.co.uk/any-answers/vat-registration-exce…

When you go over the 85k rolling threshold compulsory threshold you are required to apply for VAT registration but as you noted on the VAT registration form there is

https://www.accountingweb.co.uk/tax/hmrc-policy/vat-online-how-to-r…

Registering to file online is simple if the business has the necessary information but there may be a delay if the original VAT registration certificate cannot be located To

Thank you for visiting this page to find the login page of Registering For Vat here. Hope you find what you are looking for!