If you are having a hard time accessing the How Do Sip Shares Work page, Our website will help you. Find the right page for you to go to How Do Sip Shares Work down below. Our website provides the right place for How Do Sip Shares Work.

https://www.fool.co.uk/personal-finance/…

Share incentive plan what s it all about A share incentive plan SIP is a potentially tax free way of being paid It s where you buy or are given shares in the company you work for and hold

https://ledgy.com/blog/share-incentive-p…

How do share incentive plans SIPs work The shares awarded as part of a SIP must be part of the company s regular share capital Whether or not SIP shares have voting rights is decided at the company s discretion

https://assets.kpmg.com/content/dam/kpmg/uk/pdf/...

Share are held on behalf of participants by a special employee share ownership trust for as long as they remain within the SIP How do SIPs work Employers can choose to offer one or

https://www.bdo.co.uk/.../share-incentiv…

The Share Incentive Plan SIP is a tax advantaged all employee plan that offers companies the ability to award equity to employees flexibly The shares awarded under a SIP are held in a trust and provided they are held for at least five

https://www.globalshares.com/uk/insights/how-to...

A share incentive plan or SIP is one of the tax efficient employee share schemes available in the UK aimed at providing employers with an easy and flexible way to offer shares in the

https://www.pinsentmasons.com/out-law…

Share incentive plans SIPs enable eligible employees of a company to acquire shares in either their employer company or in the case of a group plan the holding company SIPs must be open to all employees who

https://www.lawbite.co.uk/.../share-incen…

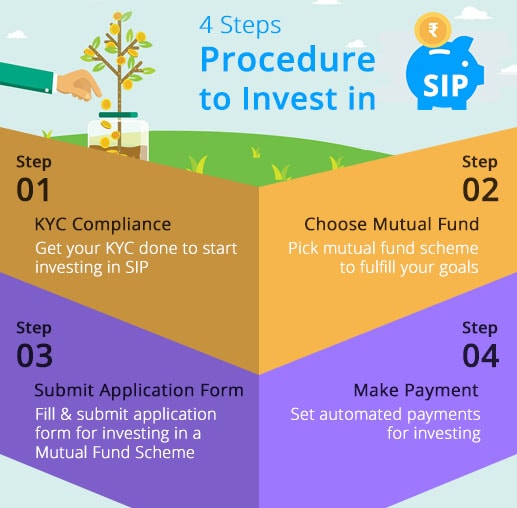

How do Share Incentive Plans work Shares can be awarded to eligible employees in three ways Free shares your employees can receive free shares of up to 3 600 per tax year

https://www.proshare.org/.../factsheet-sip.PDF

The SIP legislation provides for four types of Plan shares to be used Free Shares employers can give each employee Free Shares worth up to 3 600 each year free of Income Tax and

https://www.shareview.co.uk/4/Info/Portfolio/...

The Share Incentive Plan SIP plan is a flexible tax efficient way for employees to hold shares in their company Frequently asked questions What are Locked in Conditional and Available

Thank you for visiting this page to find the login page of How Do Sip Shares Work here. Hope you find what you are looking for!